MyProNoblis

Invest

ProNoblis

Leipzig

Aktuelle Informationen zum Corona-Virus

"ProNoblis" is derived from the Latin language. Freely interpreted, it means as much as "We for us" – and thus describes the core of our philosophy. Because ProNoblis is help for self-help: from us, for us. Since 2003, we have been working successfully to bring both companies and investors together and to create alternatives to bank offers – we understand ourselves as a provider of financing solutions for SMEs (small and medium-sized enterprises) and as an wealth accumulation partner for private and institutional investors. We merge our competences within the ProNoblis AG since August 2018 as the predecessor company, which existed since 2013 was formally transformed into ProNoblis AG.

We provide SMEs with working capital and fresh capital (short- and medium loans and equity-replacing subordinated loans).

We benefit from decades of experience in the credit business for granting of subordinated loans, loans and working capital to medium-sized companies and from our broad network.

Our Solutions

Goods purchasing financing

loan

subordinated loan

ProNoblis financing and asset classes

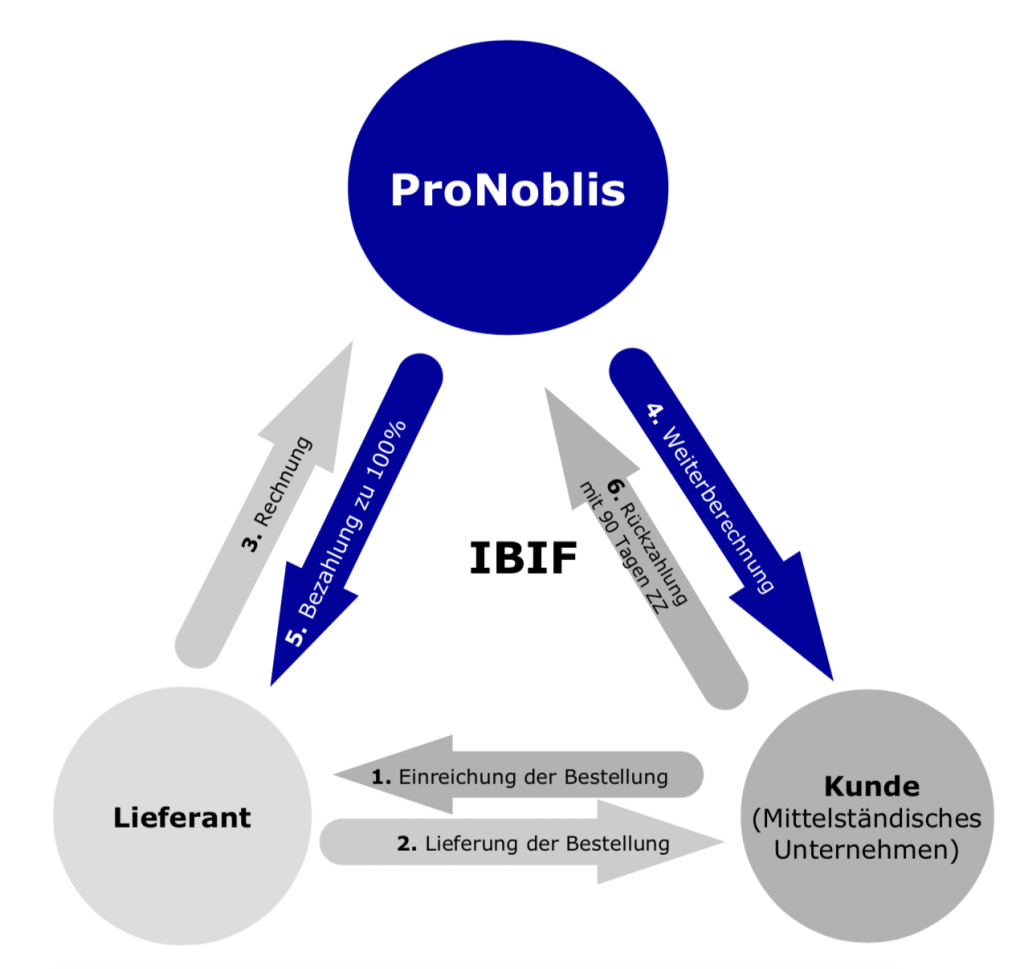

1. asset class Working Capital / IBIF: InBetweener-Invoice-Finance: Planned, calculated pre/interim financing of goods orders with up to 90 days payment period. Trade credit insurance serves as collateral.

2. asset class subordinated loans ( investments > 1 year maturity): provision of subordinated loans to improve the equity ratio of companies – always linked to investments. In advance, ProNoblis carries out an internal review and risk classification of the companies and projects. We thereby give corporate customers the opportunity to advance growth projects independently from bank financing and/or in addition to existing bank loans.

3. asset class loans: Short maturities create manageable capital commitment and risks with interest rates of 2.9 - 6.0%. All our loans are secured by promissory notes. Since 1530, world trade has been built up secured by promissory notes. We create attractive financing for SMEs without making things complicated.

IBIF - ProNoblis' solution for Working Capital

Reasons for your cooperation with ProNoblis

Expertise & Consulting

Our experts are ready to help you with your questions.

Partner of the Mittelstand

We offer fast and easy solutions for Corporate Financing since 2013

Global network

ProNoblis is successful with it's network. Our partners are global and support you with your international activities.

ProNoblis AG

Who are we?

Success requires the right partners – because right partners make a significant contribution to the success of a company.

ProNoblis AG is your partner for the procurement of industrial goods.

We negotiate prices and discounts for you with suppliers and give you the financial leeway you need to fulfill your short-term orders.

We are established since 2013 and a partner of the Mittelstand and are a public company since 2018. Additional to the full-service goods purchasing financing solution, we offer loans and subordinated loans.

Experienced Management

Stefan Schmidt

CEO

Stefan Schmidt worked for many years for various banking groups in the corporate customer business and was last responsible for the Business & Corporate Banking division of a major international bank in the North-Eastern region of Germany. He has also been an entrepreneur since 2003 and has managed several national and international companies with success.

Ulrich Rump

CHAIRMAN OF THE SUPERVISORY BOARD

Ulrich Rump is a lawyer with his own law office in Berlin. He has expertise and many years of experience in various specialist disciplines, such as claims management.

In addition, he has been active as an entrepreneur for many years and has successfully been involved in several companies.

Prof. Dr. Georg Donat

MEMBER OF THE BOARD

Prof. Dr. Georg Donat was a authorized representative at a major international bank in Leipzig.

He is a member of several supervisory boards. As a board member (president) he manages the Marketing Club Leipzig, which has developed into a meeting place for executives from business, science, culture and administration.

Susan Kessler

MEMBER OF THE BOARD

Susan Kessler has been a board member of the IMW Interessenvereinigung Mittelständische Wirtschaft e.V. for more than 10 years. She focuses on the preventive solution of challenges in business management and marketing for SMEs. Ms. Kessler is also an all-round financial expert and was responsible for many years as product manager for the asset management division of a well-known bank-related sales organization.

Our Mission

The consequences of the financial crisis, stronger regulations (Basel IV) and the withdrawal of banks from this segment are making it increasingly difficult for companies to finance their growth, trade and investments. Small and medium-sized enterprises (SMEs) in particular have problems adapting to the completely different capital market situation. Unlike in earlier upswings, they are no longer able to rely on traditional bank loans in the usual extent. Based on this, financing needs of companies are rising continuously. Especially for SMEs which, due to their size, have no or only very limited access to alternative financing possibilities via public capital markets.

ProNoblis offers innovative financing instruments to SME as a supplement or/and alternative to working capital loans and overdraft facilities. With more working capital, companies can secure their liquidity flow and finance the purchase of goods and projects and in a structurated and targeted manner.

ProNoblis offers innovative financing instruments to SME as a supplement or/and alternative to working capital loans and overdraft facilities. With more working capital, companies can secure their liquidity flow and finance the purchase of goods and projects and in a structurated and targeted manner. We are thus closing the structural gap in the supply of credit for small and medium-sized enterprises, which has become wider since the financial crisis. We give SMEs access to highly attractive financing alternatives that are much faster and less complicated than factoring, supplier loans or bank loans.

Our sales hubs

Local, connected: Simply there for you!

ProNoblis is different, in many ways.

We offer SMEs smart working capital financing - IBIF InBetweenerInvoiceFinance, which is only provided by us.

We combine traditional, well-functioning relationship sales with the advantages of the digital world: speed, availability and cost optimization. With us, customers receive comprehensive service, individual advice and unrivaled speed in loan processing. This is how we guarantee lasting customer relationships!

The ProNoblis contact persons are personally available for you on the D-A-CH market.

We are expanding our locations!

Collaterals

Data Protection & Privacy

We don't need access to our customers' bank accounts. Corporate and private customers do not have to provide us with their account PIN, as in most cases with other providers. We want to preserve the right to privacy – especially in the digital era!

Our Vision

Our Partners

Our Initiatives

Open Business Forum - the hybrid event series.

On site and via livestream. Sponsored by ProNoblis & CRIF. Find out more now

Two strong partners - one goal: in times like these, sharing experiences is more important. Our Open Business Forum gives all SME decision-makers the opportunity to discuss their own needs and define common goals in an exclusive setting. Be part of it. Get involved with us in the Open Business Forum!

We organize four hybrid events a year. We enable personal participation on site but also participation via video transmission. The Speakers Night opens with a keynote speech, followed by a high-caliber panel with networking opportunities inside and outside the Open Business Forum. The Open Business Forum is an offer for entrepreneurs and companies.Register now for the next event!

Book an appointment

for an individual consultation

Call us

030 790 16 58 80

Contact us

We are looking forward to your message